VAT (Value Added Tax) is a tax added to most products and services sold by VAT-registered businesses.

Businesses have to register for VAT if their VAT taxable turnover is more than £85,000. They can also choose to register voluntarily if their turnover is less than £85,000.

Being VAT Registered

Once your business is registered for VAT you have responsibilities in ensuring your business handles VAT correctly. As a VAT-registered business you must:

- include VAT in the price of all goods and services at the correct rate

- keep records of how much VAT you pay for things you buy for your business

- report the amount of VAT you charged your customers and the amount of VAT you paid to other businesses by sending a VAT return to HM Revenue and Customs (HMRC) – usually every 3 months

- pay any VAT you owe to HMRC

Once you are VAT registered, our accounting software Simplifi makes the VAT administration for your business straightforward, and ensures you meet all your obligations mentioned above.

So What VAT Rate Do I Charge?

Once you are VAT registered, you then need to start adding VAT to your Invoices. The vast majority of our clients provide Services to their end clients (as opposed to Goods), so the following information relates to a VAT registered business providing Services.

VAT rate of 20%. Most (if not all) our clients will charge VAT on their services to UK based clients at a rate of 20%. Every single line item on your Invoice should be charged at 20% VAT.

VAT rate of 0%. Some goods/services are charged at 0%. We would not normally expect any of our clients to use this rate. Examples are (1) selling books/newspapers, (2) selling children’s clothes/shoes, (3) selling motorcycle helmets. You can see these are all the supply of Goods, and not Services. For a detailed list please see VAT rates on different goods and services. If you are a UK business selling Goods outside the UK, these will be charged at 0% VAT.

Exempt of VAT. There are some goods and services on which VAT is not charged, including (a) insurance, finance and credit, (b) education and training (c) fundraising events by charities. While we expect some of our clients will be working in these sectors, typically they will not be the supplier of these services to the end customer, but rather are a link in the overall supply chain for an end client that does actually supply these services to an end customer. We would not normally expect any of our clients to be providing VAT Exempt goods or services.

There is one exception for some clients, and that is for those who have residential property to let. Generally speaking, letting residential property is exempt from VAT. However, if it is a furnished holiday let (or an Air BnB property) the normal rate of 20% VAT must be added to all invoices.

Outside Scope of VAT. This would be the other VAT category we would expect to see on our clients invoices. This relates to services supplied to a Business that is based outside of the UK. So for example, if you provide professional services to a French firm, or a US company, then use the “Outside Scope” VAT category on your invoice.

Charging for Expenses

Sometimes our clients will invoice a client for services provided along with Expenses that are to be reimbursed. For example, if they need to visit a client site, and the client has agreed to pay for their travel costs and accommodation, then you will add these Expense items onto your next invoice.

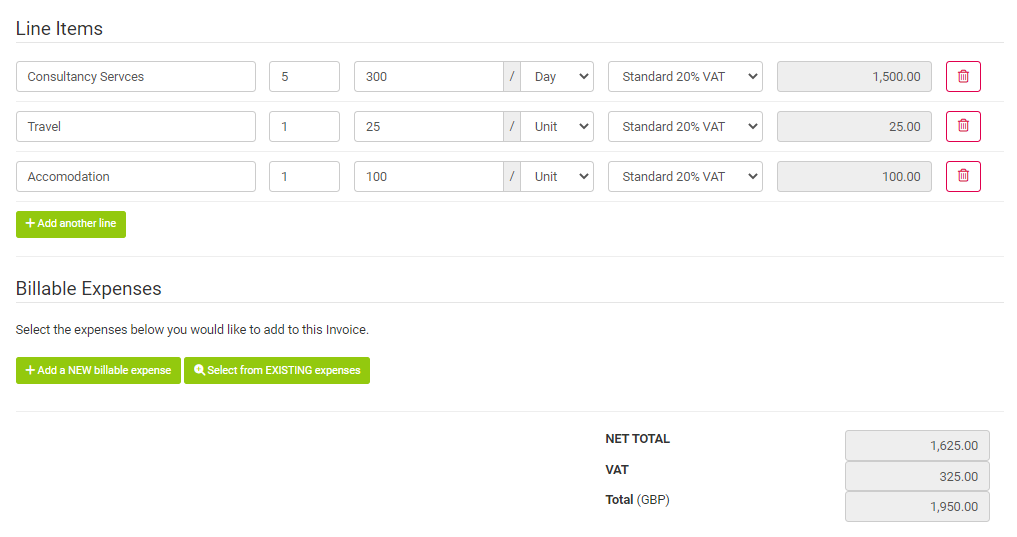

A question we are commonly asked is what rate of VAT do you add on your Invoice for the Expense? For example, Jen works for a UK based client and bills them £300 per day, plus 20% VAT. They have asked her to attend a meeting at their head office and have said they’ll reimburse her for travel and accommodation costs. Her travel cost was £25 (no VAT on travel), and accommodation was £120 (incl 20% VAT). On her next Invoice she will charge for 5 days work, plus the reimbursement of Expenses. Her invoice will look like this;

Note 1: Although no VAT is charged on travel, she must charge 20% on top of the travel cost to her end client because the Travel was incurred by Jen as part of supplying her services.

Note 2: Jen has taken VAT off the accommodation cost, and charged her client £100. VAT at 20% is added to this at the bottom of her invoice. This is cost neutral to Jen.

General Note: Are you free to bill your client whatever you like for the Expenses you have incurred. It does not HAVE to be the actual cost that you incurred. Some clients will bill the actual cost + 10% to allow for the time taken to actually book tickets, pay for them etc. However in most cases our clients tend to charge their clients for Expenses at the actual cost they were incurred at, in which case they would take off any VAT and add that amount to the “Rate” input box on the Invoice line.