The Pensions Regulator requires your business to complete this form to let them know that your business has met its legal duties for automatic enrolment and re enrolment.

The vast majority of our clients do not have any automatic enrolment duties because for the purposes of auto enrolment they are not considered an employer.

For example a company will not have any duties if (a) they have just a sole director and no other staff, or (b) they have multiple directors none of whom have an employment contract, and no other staff.

Regardless though a declaration of compliance is still required. Here we will outline the steps to complete the declaration of compliance on the basis that it does not apply to your company.

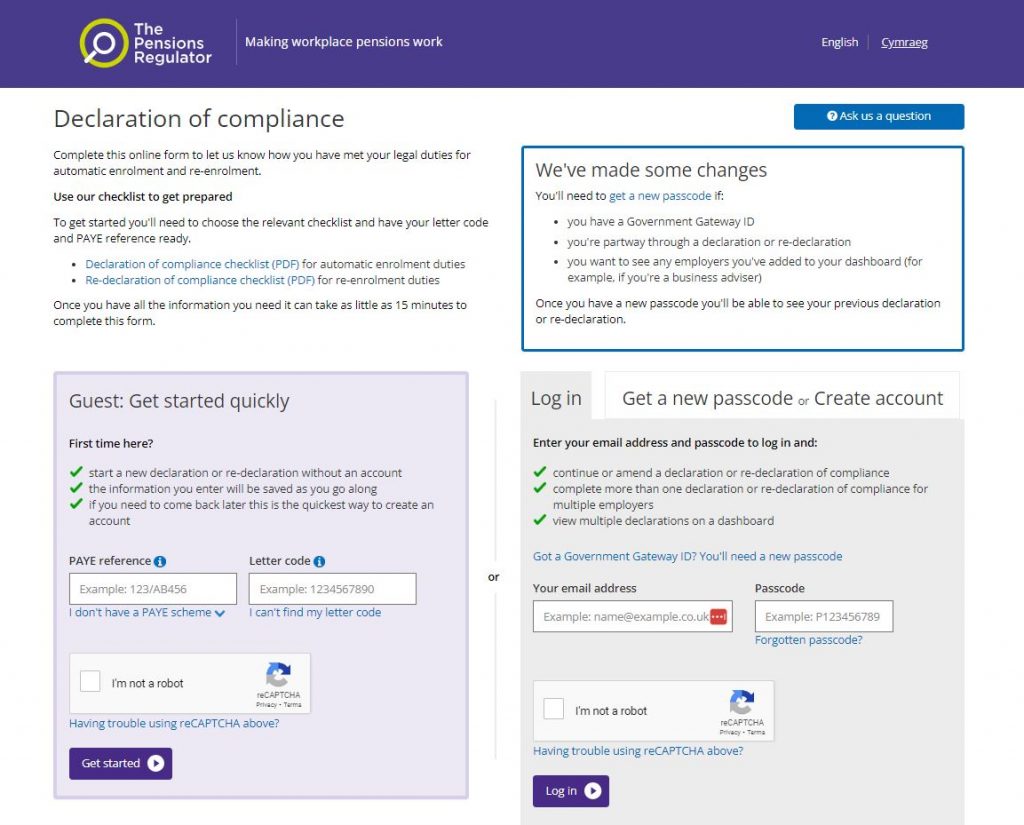

Step 1 – Login

Go to https://www.autoenrol.tpr.gov.uk/TPRGateway/Home and under the “Guest: Get started quickly” section complete your company PAYE reference and your Letter code. The letter code is a unique 10 digit number shown at the top of each re enrolment letter you received from the Pensions Regulator. If you don’t have it though that’s fine, click the “I can’t find my letter code” link and add your company Accounts office reference number.

If you are not sure of either your PAYE reference or Accounts office reference number you can find them on your online portal. Once you have logged in then under your name (top right) click the “Business info” menu item, and you will see the details under the “Company Tax settings” section.

Step 2 – Complete tabs

Once you get through to the Reed declaration pages you will find there are nine tabs of information that need to be completed. The first tab is titled “Getting Started” which just display some basic instruction for you.

Within the next two tabs called “About you” and “About the employer” complete your personal and Business Contact information.

The next tab “PAYE scheme details” just displays your PAYE reference details and there is nothing further to do on this page

The next tab “Pension scheme details” will not display any pension details because none apply to your business. Tick the box next to “Tick this box if you are not using any pension schemes for automatic enrolment or re-enrolment” and proceed to the next tab.

The next tab “Re-enrolment” select “No” for the first question, and leave the “Re-enrolemnt date” at the default value.

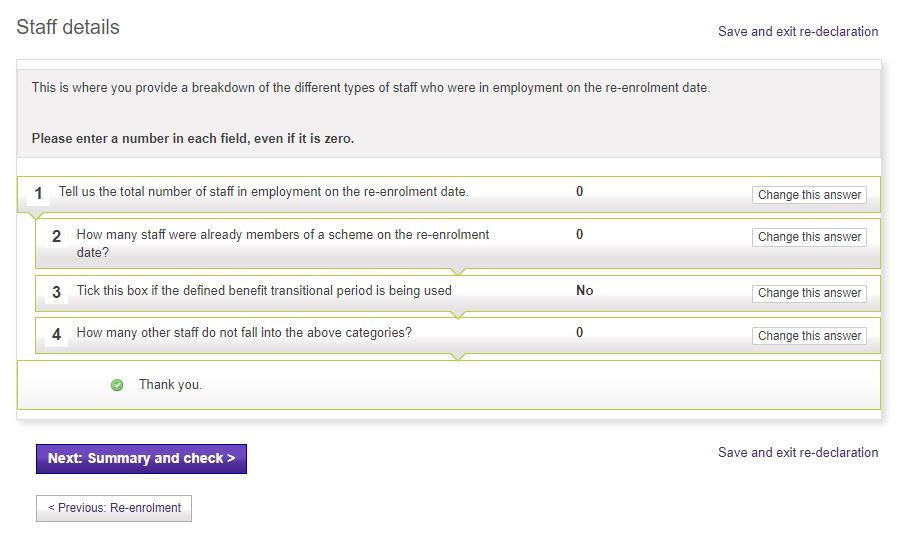

The next tab “Staff details” shows the total number of staff that you have that fall within the auto enrollment requirements. Remember at the start of this guide we said the vast majority of our clients have no staff that fall within the auto enrollment requirements so we suggest you complete this as per below;

Step 3 – Summary tab

The second the last tab is called “Summary and Check” and this is just a summary of your answers to all the previous tabs.

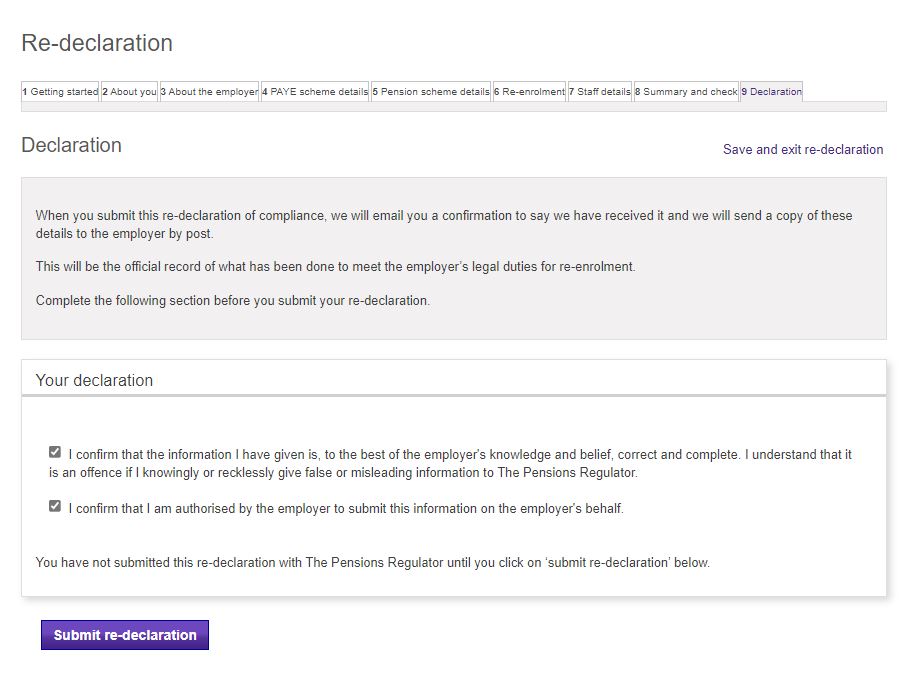

Step 4 – Declaration tab

And the final step is completing the declaration tab. Here you simply read the information, tick the two boxes to confirm you agree, and then press the “Submit re-declaration” button. See example below.